Let’s keep it simple. Why should a small business’s property tax double the amount of the previous owner simply because he/she purchased the business 2009?

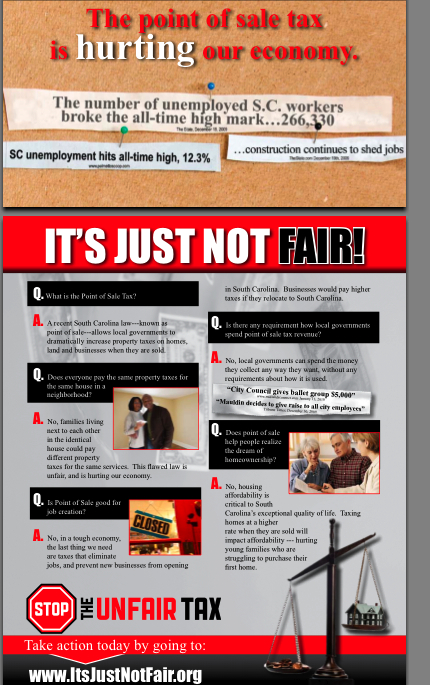

A major feature in the property tax reform legislation of 2006 was the cap on re-assessment. However, the cap does not apply when the property changes ownership. This “un-capped” assessment creates a tremendous inequity on property tax rolls. This new multiplying tax bill has discouraged investment in industrial development and is hurting the already struggling real estate market.

The “un-capped” assesment still affects the homeowner and I regret S. 3272 doesn’t address the homeowner. However, the homeowner did recieve property tax relief in 2006 and commercial property did not.

We can’t allow this reaping of excess tax dollars at the expense of South Carolinia businesses simply trying to live the American dream! from itsjustnotfair.org

comments