small school choice amendment passes SC Senate budget

Amendment 137.d allows for Scholarship Granting Organizations to give scholarships to exceptional needs students. We tried universal school choice on Wednesday May, 22 and the amendment was tabled by a significant margin. Amendment 137.d is a very small step, however, it is a positive step to assist families with exceptional needs children in that it gives them a choice of where they obtain their child’s education.

Amendment 137.d allows for Scholarship Granting Organizations to give scholarships to exceptional needs students. We tried universal school choice on Wednesday May, 22 and the amendment was tabled by a significant margin. Amendment 137.d is a very small step, however, it is a positive step to assist families with exceptional needs children in that it gives them a choice of where they obtain their child’s education.

The amendment allows for taxpayers that contribute to a scholarship funding organization, to apply for a tax credit of that amount up to $ 10,000. The total amount of credits given will be capped at $5million. This is a budget amendment, therefore, it is only available for the fiscal year 2013-2014. Let’s hope this new option for parents will be well received by all.

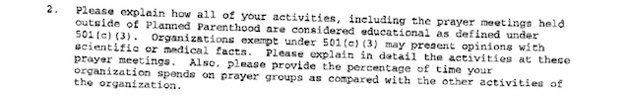

yahoo: IRS asked pro lifers about content of prayers

While applying with the Internal Revenue Service for tax-exempt status in 2009, an Iowa-based anti-abortion group was asked to provide information about its members’ prayer meetings, documents sent by an IRS official to the organization reveal.

While applying with the Internal Revenue Service for tax-exempt status in 2009, an Iowa-based anti-abortion group was asked to provide information about its members’ prayer meetings, documents sent by an IRS official to the organization reveal.

On June 22, 2009, the Coalition for Life of Iowa received a letter from the IRS office in Cincinnati, Ohio, that oversees tax exemptions requesting details about how often members pray and whether their prayers are “considered educational.”

“Please explain how all of your activities, including the prayer meetings held outside of Planned Parenthood, are considered educational as defined under 501(c)(3),” reads the letter, made public by the Thomas More Society, a public interest law firm that collected evidence about the IRS practices. “Organizations exempt under 501(c)(3) may present opinions with scientific or medical facts. Please explain in detail the activities at these prayer meetings. Also, please provide the percentage of time your organizations spends on prayer groups as compared with the other activities of the organization.”

The IRS is currently under fire for allegedly targeting conservative groups that applied for nonprofit status in recent years. In response, two IRS officials have stepped down, including Acting Commissioner Steven Miller.

That portion of the questionnaire, in which the IRS also asked about signs the group intended to carry at rallies at Planned Parenthood offices, read on

pharmacy regulation amendments h.3161

H.3161 is legislation cleaning up regulations for pharmacy compounding. I have two amendments that will be offered whenever the bill is taken up.

H.3161 is legislation cleaning up regulations for pharmacy compounding. I have two amendments that will be offered whenever the bill is taken up.

1-The current system allows for a pharmacist to supervise 2 technicians or 3 if 1 out of 3 are board certified. The board certification is an extra level of education that some technicians have. Board certified technicians have extra responsibilities, but in my 24 years of experience, I have seen minimal benefit to this extra education. My amendment allows a pharmacist to supervise 3 technicians whether certified or not. Increasing the pharmacist to pharmacy technician ratio frees up the pharmacist to spend time with their customers helping them understand their medication therapy.

2-Currently, pharmacists are required to get 15 hours of continuing education. The law requires that some of these hours be obtained at a live presentation and the rest either live or home study. The amendment changes this mandate and gives the pharmacist the option of getting all 15 hours live, home study, or a combination of both.

the budget debate’s fuzzy math

Let’s say I ask you for $10, yet you’re only able to give me $9. A reasonably logical person would thank you for the $9 gift. However, according to Columbia logic, I should whine & pout because you cut me out a dollar.

Let’s say I ask you for $10, yet you’re only able to give me $9. A reasonably logical person would thank you for the $9 gift. However, according to Columbia logic, I should whine & pout because you cut me out a dollar.

Sen. Lee Bright (R-Spartanburg) introduced a series of amendments diverting extra revenue to our dilapidating roads and crumbling bridges. The state portion of this year’s budget contains an estimated $700 million extra over last year. Remember the state portion is only a 1/3 of the pie. There are Federal Funds and other funds in the mix. One amendment called for 10% of the state funds to go to roads, and two other amendments for 5%, and 1%. All tabled by the rinocrat majority. See the math below if you like.*

They stand on this logic: “You can’t make these cuts, you’re cutting education! It will threaten our triple A credit rating”.

Well, let’s look at the first argument. One of the education line items this year is nearly $2.2 billion, $122 million over last year’s appropriation. These amendments may decrease the proposed increase request, but it’s not a cut. The 10% amendment leaves an increase of $23 million, 5% $69 million, and with the 1% roads amendment this education line would still get an increase of $115 million.

As for the triple A credit rating? Y’all know I don’t like debt, however, since my colleagues continue to borrow and spend, your grandchildren will at least get a decent rate on the inherited debt. But this thing about the credit agencies will frown on general funds being spent on roads is somehow to our disadvantage is a red herring. Many states spend general funds this way.

There’s no logical argument against the fiscal responsible approach to spending what we have on core functions of government like roads. Most politicians would rather spend your money on fluff behind your back, then come to you and say “look at our roads, we have to raise your taxes and increase your debt, it’s our only option”.

The borrowing and tax hikes for roads are coming, so grab your wallet with both hands!

*amendment calculations

*amendment calculations

10% amendment: $636m to roads, $64m to grow government ($23m education)

5% amendment: $318m to roads, $382m to grow government ($69m education)

1% amendment: $64m to roads $636m to grow government ($115m education)

- « Previous Page

- 1

- …

- 69

- 70

- 71

- 72

- 73

- …

- 400

- Next Page »