|

|

|||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

Adrian Rogers quote

“You cannot legislate the poor into prosperity by legislating the wealthy out of prosperity. What one person receives without working for, another person must work for without receiving. The government cannot give to anybody anything that the government does not first take from somebody else. When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that my dear friend, is the beginning of the end of any nation. You cannot multiply wealth by dividing it.” Adrian Roger

Tom Davis: Make S.C. tax code fair, competitive

One of the problems with state government in South Carolina — aside from the fact that it is too large, wasteful and inefficient — is that it routinely makes decisions that benefit well-financed special interests rather than the best interests of the people.

How can that be in a representative democracy? Well, start with the fact that there are currently 377 lobbyists representing 534 companies and organizations at the Statehouse, each of them pushing for special treatment for their clients.

Next, look at the fruits of those lobbyists’ labor: Our tax code has 112 sales tax loopholes. There is no rhyme or reason to these tax breaks; they range from portable toilet rentals to time shares, newspapers to direct mail postage, amusement park machinery to manufactured housing.

And then look at our state’s “tax incentives” carousel. In the past decade, the special tax breaks doled out by the Legislature — special exemptions from taxes that the rest of us have to pay — have increased from $32 million to $254 million a year.

Public officials like incentive deals because it gives the appearance that they are “doing something” to create jobs. But while government press releases gush about how those deals “create” jobs, they never mention the extra tax burden that falls on everyone else in order to pay for them — a burden that ends up destroying more jobs than are created.

It makes no sense to have a tax system that encourages private parties to fight over obtaining public favors. When it becomes profitable for them to put time and money into lobbying politicians for favors, then that is precisely what they will do. Why encourage such unproductive behavior?

And why let government pick winners and losers in the marketplace in the first place? Public officials should avoid what Nobel laureate Friedrich A. Hayek called the “fatal conceit” and leave that chore to the private sector and the profit and loss system. Top-down economies planned by government fail; those driven by the private sector and the free market flourish.

Unfortunately, however, our state’s economy is rapidly becoming top-down driven. As the South Carolina Policy Council documents in “Unleashing Capitalism,” total government spending in South Carolina amounts to 40.5 percent of the state economy — the 10th highest percentage in the nation — while North Carolina’s and Georgia’s is only 32 percent and 30 percent, respectively.

The private and public shares in a state’s economy, of course, add up to 100 percent and our goal should be to maximize the former’s share and minimize the latter’s. But South Carolina is doing the exact opposite, increasing state intervention in the economy and sliding toward the government percentage of the least prosperous state (West Virginia at 50 percent) and away from the most (Connecticut at 20 percent).

As the Policy Council notes, South Carolina has a hard-working labor force, abundant natural resources, excellent ports and major metropolitan areas, yet our per capita income is only 80 percent of the U.S. average. And what holds us back is our state government’s policy of doling out tax favors to the well-connected and trying to pick winners and losers in the marketplace. Here’s what we should do:

First, declare that no South Carolinian gets special treatment at the expense of another and call for all special sales tax breaks to expire by a certain date unless a new law is passed to keep them. Some exemptions, such as the one on grocery sales, make sense and are broad-based. But since the 112 special tax breaks represent about $2.5 billion annually, closing even a fraction of them would result in a huge revenue increase.

Second, resist the temptation to spend that new revenue. Yes, there have been substantial budget cuts in the past two years, but state government spending grew by 41 percent in the four years prior. Per capita state government spending in South Carolina is still 22 percent higher than Georgia’s and 13 percent higher than North Carolina’s. State government has enough money to discharge core functions if it is forced — as private households are — to spend wisely.

Third, use the new revenue to lower the state sales tax and the state income tax across the board so that everyone pays lower taxes, not just the politically connected. Lower taxes for everyone promotes free market entrepreneurship and discovery — the true sources of prosperity.

These straightforward changes to how we tax in South Carolina would simplify our tax code and put us on the cutting edge of tax policy nationwide. They would make us a magnet for jobs and investment at a time when other states are poised to enact massive tax hikes.

More importantly, these changes would put more money into the pockets of the people whose hard work drives our economy — the South Carolina taxpayers.

Additional Facts

Ryberg: Tax dollars should help, not hurt businesses

South Carolina newspapers have recently reported on legislation that provides taxpayer funds for a shopping mall in Jasper County. The developers of the mall, based upon their own projections, would receive the benefit of $131.5 million of your tax money. That provision led me to block the bill in the Senate. I oppose taxpayer funding of common economic activities such as building a shopping mall.

One article quoted several public officials who either expressed confusion at my stance or charged that I simply misunderstand the definition of economic development.

Optimal tax policy rewards all individuals, personal or corporate, in the same way and to the same degree merely by their engagement in the free market. Tax breaks should not be used to pick winners and losers.

The article also quoted one well-paid Columbia insider who has lobbied my office for this specific tax break. He asserted that I stood in the way of a deal that, “would bring 2,000-2,500 new jobs to the area.”

The only thing “new” about the jobs would be their location. Sembler, the developer of the proposed taxpayer-funded mall, produced a site plan dated July 2009 – or about two months after the well-paid Columbia insider told the General Assembly that this mall would bring “new retailers” and “new jobs” to Jasper County. It shows retailers like Marshall’s, Sam’s Club, Kroger and Lowes.

Nearly all of the retailers listed on the plan already do business within a very short distance of the proposed taxpayer-funded Sembler development. The current employees would simply drive 10 minutes more to work.

The fact is that Sembler plans to attract tenants from across town by using low-cost infrastructure, paid for by taxpayers, to undercut the other mall. This is taxpayer-subsidized piracy.

This piracy would not only cost state taxpayers tens of millions of dollars, half of which would come straight out of classrooms, but also cost Beaufort County taxpayers an untold sum if Hilton Head Village closed because it could not compete with the taxpayer-funded mall in Jasper.

My office has also learned that the Tanger Outlet Centers has plans to invest up to $40 million in the refurbishment of one of its centers in Beaufort County. Tanger undoubtedly now questions the prudence in investing its own money in competition with another company receiving taxpayer funds. If and when Tanger suffers the same fate as Hilton Head Village, then Beaufort County taxpayers will take an even larger hit.

The Sembler site plan, moreover, shows no evidence of “high-end” outlets. But even if the taxpayer-funded mall did house such stores, they too – with their taxpayer subsidies – would undercut retailers of such goods that already exist in Bluffton and Hilton Head, thereby destroying even more businesses with your tax money.

Legislation that leads to the eventual destruction of good existing businesses, whatever their product lines, is the definition of “picking winners and losers,” and that is no business of politicians.

The cost to the taxpayer likely will not end with the giveaway of their money. Similar giveaways this year have met lawsuits in Arizona and Wisconsin. Arizona courts have struck down one such deal, and the others are pending. The plaintiff in Washington County, Wis., has said that his lawsuit “has everything to do with using taxpayer money to subsidize a for-profit company in order to lower its costs on a retail project.”

When South Carolina businesses ruined by tax incentives for Sembler sue the General Assembly for unfair trade practices, guess who pays for that – you. You pay to fight the suit and you pay the penalty when the plaintiffs win.

Finally, awarding tax incentives for a shopping mall simply because the developer hired expensive Columbia lobbyists only further violates my duty to taxpayers. I doubly oppose special tax breaks for those who simply can afford the high price of lobbyists.

The Columbia insiders who peddled this deal in the General Assembly made claims that no one now can verify. They traded on their relationships to tap into your money.

This is not a story about economic development and new jobs. It is a story about power politics, insider deals and economic piracy, all at taxpayer expense.

The sum of this tale is that a well-heeled developer hired well-connected lobbyists to secure tens of millions of taxpayer dollars in order to steal away customers from existing businesses. Lobbyists and those who can afford them stand to make out like bandits while the taxpayers pay the price. I object.

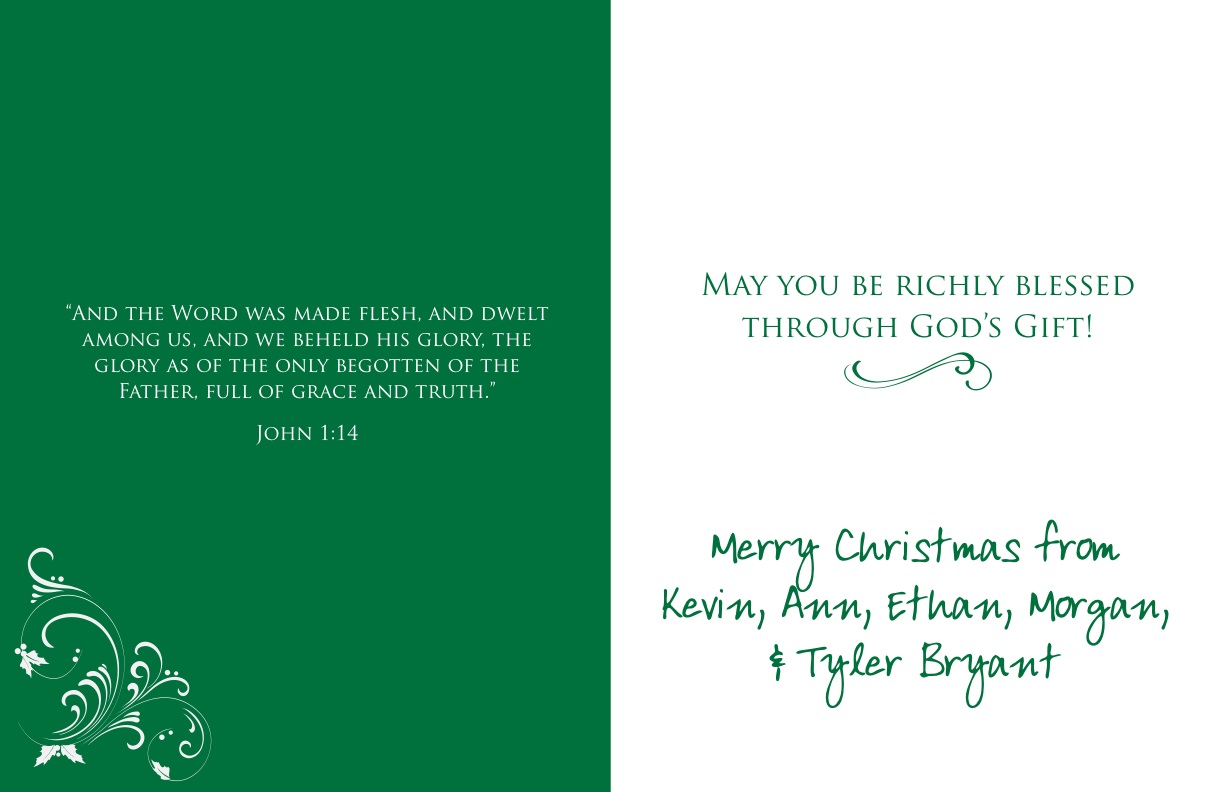

Merry Christmas!

- « Previous Page

- 1

- …

- 229

- 230

- 231

- 232

- 233

- …

- 400

- Next Page »