Anderson College, February 15th at 7:30pm. Sponsored by the Anderson County Republican Party Online TV Shows by Ustream

s. 1167 deletes a dumb law

I’ve coauthored a bill, S. 1167, with the Chief Justice of the Senate, Senator Larry Martin. S. 1167 deletes the “subversive activities registration act” (Chapter 29, Title 23 of the 1976 code).

This act smacks the face of the foundation Declaration of Independence:

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable rights, that among these are life, liberty and the pursuit of happiness. That to secure these rights, governments are instituted among men, deriving their just powers from the consent of the governed.

then a mandate in the Declaration of Independence:

That whenever any form of government becomes destructive to these ends, it is the right of the people to alter or to abolish it, and to institute new government…

No come on. Do you actually think a group that intends to over throw the government “by force or violence or other unlawful means” is actually going to “register with the Secretary of State on forms”?

S. 1001 limits volunteer driver liability

Every year the Silver Haired Legislature give us a report on recommended legislation. Here’s my favorite one, S. 1001. This bill only makes sense. It limits the the civil liabilities for good samaritans.:

“Section 15-1-315. No licensed driver operating an insured vehicle to transport seniors or persons with disabilities who renders service voluntarily and without compensation or the expectation or promise of compensation, is liable for civil damage beyond the limits of his automobile insurance liability coverage, so long as the driver’s coverage meets the minimum liability requirements for South Carolina, for any act or omission resulting from the rendering of the services unless the act or omission was the result of the licensed driver’s gross negligence or willful misconduct.”

point of sale compromise fails

I wasn’t too crazy about the compromise with local governments, but it did not get the necessary 31 votes for passage. It needed 31 votes because it involved some constitutional changes defining assessment. Here’s a summary of the bill:

H. 3272

Assessable Transfer of Interest (ATI) – Point of Sale

SECTION 1 – Exempts 100% of the value of a 6% ATI in 2010. Moratorium on increases in taxable value due to ATI.

Exempts 20% of the value of a 6% ATI all year thereafter.

However, the 20% exemption does not apply if the exemption would cause the fair market value to drop below the FMV carried on the books of the assessor, and FMV on the books becomes the new FMV.

Also, the 20% exemption does not apply if the FMV as determined at the time of the ATI is lower than the FMV carried on the books, and the new FMV would be the FMV as determined at the time of the ATI.

SECTION 2 – Further explains what is and what is not considered an ATI.

A. What is NOT an ATI

10 – transfers of undivided, fractional ownership of not more than 50%…this brings tenants in common into the same place as corporations and partnerships (BAT Bill)

11 – transfer of a single member LLC that is not taxed separately as a corporation (BAT Bill)

12 – granting of easements ( BAT Bill)

13 – transfers to quiet and confirm title…encourages property settlements (BAT Bill)

14 – creating or terminating joint tenancy…typically used for estate planning purposes (BAT)

15 – transfers to children on 4% property only

16 – transfers of 20% or less between individuals

B. What is an ATI…but really further defines what is not an ATI

8 – transfers amongst tenants in common that are not subject to federal income tax including transfers to spouses..this is a further clarification on 11 above.

SECTION 3 – Lookback on Millage Cap – Allows local governing bodies (counties, municipalities, school districts) to impose unused allowable mills from the preceding 3 tax years.

-This would prevent locals from feeling forced to increase mills up to the millage cap every year…even if they eventually put on all the unused mills, the taxpayers would have kept their money longer

SECTION 4 – Rollback Millage – Calculates the rollback millage on the amount billed as opposed to the amount collected by the adjusted total assessed value. Also, it includes increases due to ATIs in the adjusted total assessed value.

-Eliminates problems of taxes not being paid, or back taxes being paid in the year of implementation.

SECTION 5 – Index of Taxpaying Ability – Creates an Index Study Committee. 8 members…4 appointed by Pro Tem 4 appointed by Speaker. The Committee must make its report by Jan. 1, 2011.

SECTION 6 – Renovations – The issuance of a building permit is not necessarily an ATI…could still be minor construction

SECTION 7 – Reduced Value – If property sells for less than the assessor says it is worth, the burden is on the assessor to prove the higher value. This only applies in an arms length transaction.

SECTION 8 – Realtor Notice – Realtor must notify the purchaser of the estimated taxes before the contract is signed.

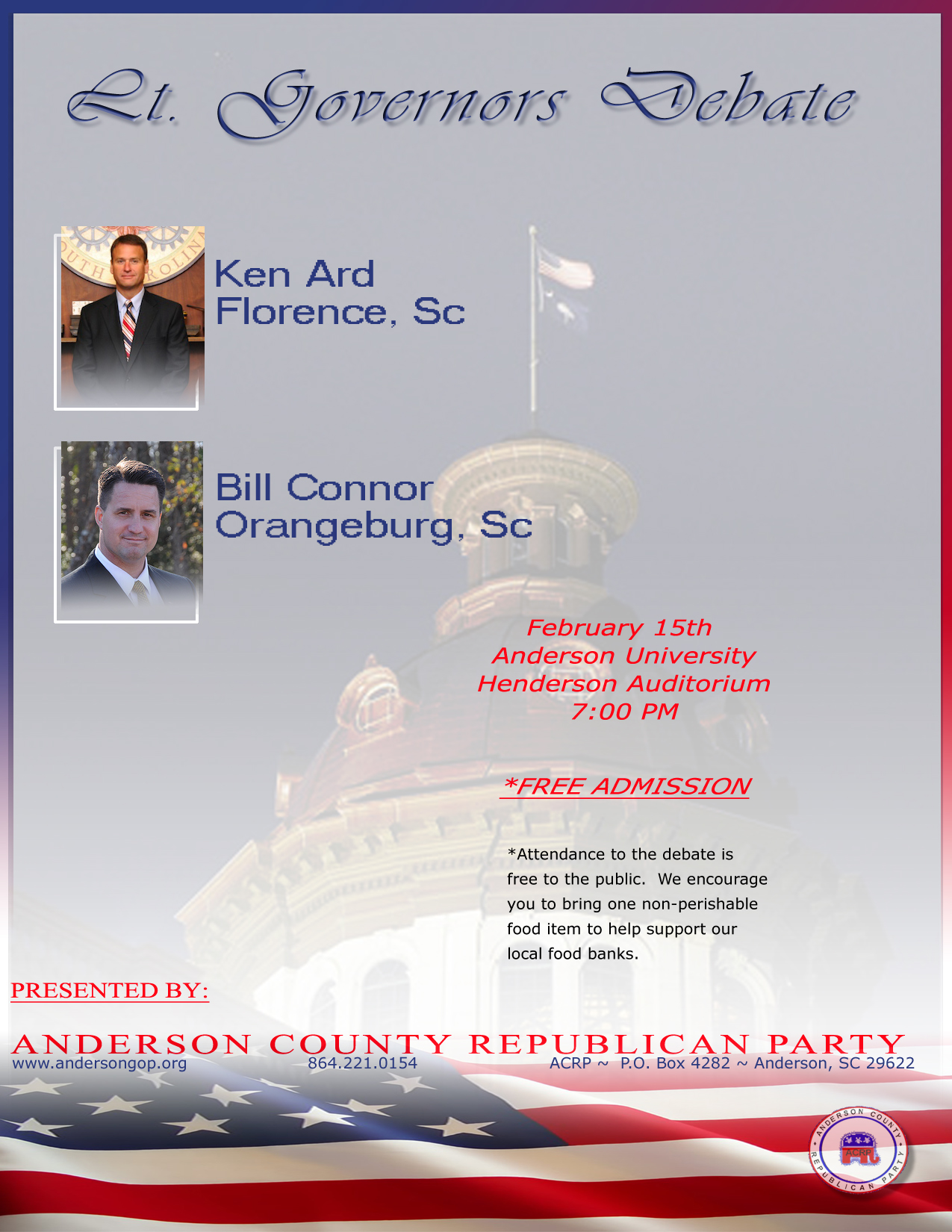

Lt. Gov debate in Anderson

- « Previous Page

- 1

- …

- 219

- 220

- 221

- 222

- 223

- …

- 400

- Next Page »